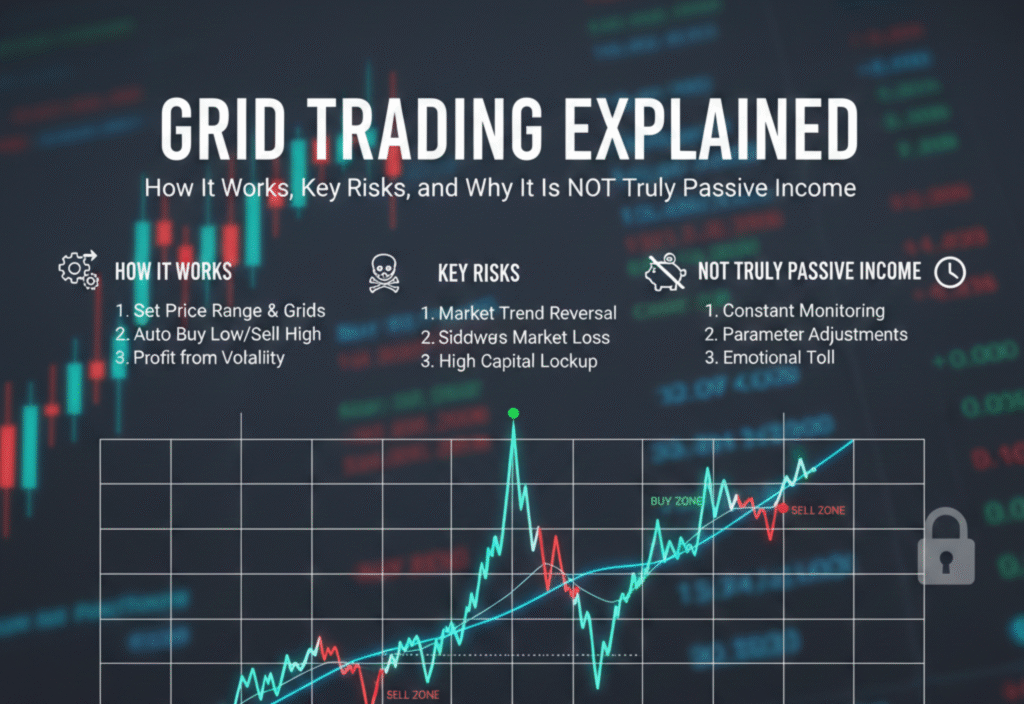

Grid trading has become a popular topic in the world of cryptocurrency and forex trading. While many consider it a “set-and-forget” strategy, it is important to understand how grid trading works, the potential risks involved, and why it cannot be considered a fully passive income method. This article will provide a comprehensive, educational, and safe overview.

What Is Grid Trading?

Grid trading is a trading strategy that involves placing multiple buy and sell orders at predetermined intervals above and below a set price. The goal is to profit from price fluctuations in a ranging or volatile market.

Unlike traditional trading, where you might buy low and sell high just once, grid trading creates a network of orders (or “grid”) to capture profits repeatedly as the price moves.

Key Features of Grid Trading:

Multiple buy and sell orders placed automatically

Profits taken incrementally as the market fluctuates

No need to predict exact market tops or bottoms

Important Note: Grid trading is purely technical and does not guarantee profit. It requires careful planning and risk management.

How Grid Trading Works

Setting a Grid

Traders define a price range in which the asset is likely to move. For example, if a cryptocurrency is trading between $20,000 and $25,000, the grid might be set within this range.Placing Orders

Buy and sell orders are automatically placed at intervals. For instance:Buy orders at $20,000, $20,500, $21,000

Sell orders at $21,000, $21,500, $22,000

Profit from Fluctuations

Each time the price moves up and triggers a sell order, the trader locks in a small profit. Similarly, when the price drops and hits a buy order, the trader purchases the asset at a lower price.Repeat Cycle

As long as the market continues to fluctuate within the grid range, the strategy repeats automatically, generating incremental gains.

Key Advantages of Grid Trading

Automation-Friendly: Many exchanges support bots to automate the strategy.

Profit from Volatility: Works well in markets with frequent price movements.

Non-Directional Strategy: Grid trading does not rely on predicting the overall trend.

However: Automation does not remove risk, and traders must actively monitor positions.

Key Risks of Grid Trading

While grid trading can generate profits, it is not risk-free.

Market Trend Risk

If the market strongly trends in one direction, your buy orders may accumulate assets that continue to fall in value.

Grid trading performs best in sideways or range-bound markets.

Capital Requirements

A larger price range requires more capital to maintain the grid.

Running out of funds may force the bot to stop operating or close positions at a loss.

Volatility Risk

Extreme market volatility can trigger losses faster than the grid can recover.

Technical or Execution Risk

Bots may malfunction, or exchange downtime can affect trades.

Errors in grid settings can result in unintended losses.

Why Grid Trading Is Not Truly Passive Income

Many marketing materials present grid trading as a passive income method. However, this is misleading for several reasons:

Active Monitoring Required

Even automated bots require supervision.

Adjustments may be necessary as market conditions change.

Market Risks Cannot Be Eliminated

Unexpected events, sharp market moves, or liquidity issues can cause losses.

Strategy Maintenance

Grids need to be reset if the market breaks out of the planned range.

Failing to adjust the grid can reduce profits or increase losses.

Psychological Stress

Watching assets fluctuate can cause anxiety if traders expect passive income without effort.

Conclusion: Grid trading can supplement a trading strategy but should never be treated as guaranteed passive income.

Tips for Safer Grid Trading

Start Small

Use a small portion of your capital to understand how the strategy works.

Set Realistic Expectations

Treat grid trading as a technical tool, not a guaranteed profit generator.

Use Stop-Loss or Risk Limits

Protect your capital against extreme price moves.

Choose the Right Market

Avoid highly trending markets for grid trading; sideways or volatile markets are preferable.

Educate Yourself

Learn market behavior, bot settings, and risk management techniques.

Final Thoughts

Grid trading is a useful tool for traders who want to capitalize on price fluctuations in a structured manner. However, it is not a shortcut to passive income. Understanding its mechanics, limitations, and risks is essential for anyone looking to implement this strategy safely.