The Heston Model is a cornerstone in modern options trading, offering a more accurate view of volatility compared to the traditional Black-Scholes approach. Unlike basic strategies that focus on price direction, the Heston Model allows traders to analyze how volatility changes over time and identify opportunities using volatility arbitrage.

This simplified guide explains the Heston Model and its practical applications, showing how traders can implement delta-neutral strategies for consistent options alpha. It is designed for educational purposes only, helping readers understand concepts without engaging in speculative or high-risk trading.

What Is the Heston Model?

The Heston Model is a stochastic volatility model, meaning it assumes volatility is not constant but changes over time. This makes it more realistic for financial markets compared to Black-Scholes, which assumes constant volatility.

Key Features:

Stochastic Volatility: Captures the moving nature of market volatility.

Mean Reversion: Volatility tends to revert to a long-term average.

Correlation with the Asset: Reflects how the underlying asset’s price affects volatility.

Volatility Smiles & Skews: Explains patterns in option prices that basic models cannot.

Why It Matters:

Understanding the Heston Model helps traders recognize mispriced options and construct strategies that are market-neutral, meaning profits are based on volatility changes rather than price direction.

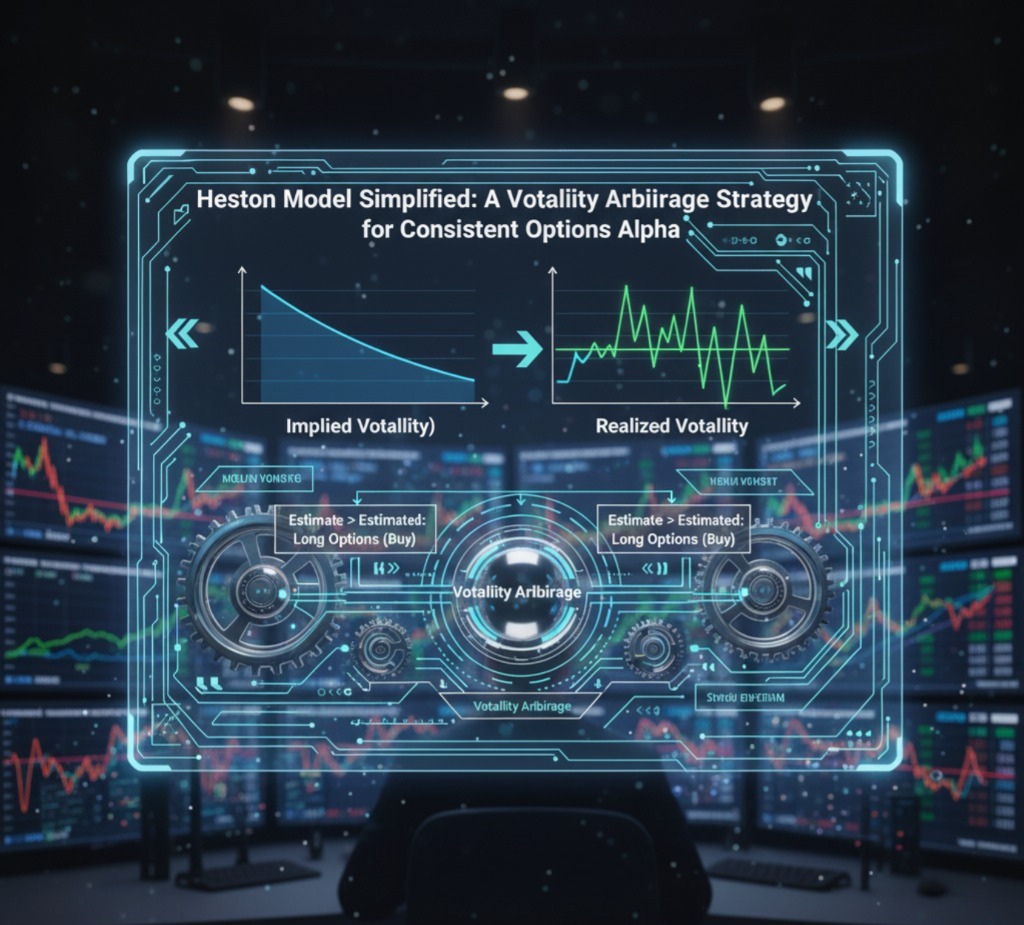

How Volatility Arbitrage Works

Volatility arbitrage is a strategy that focuses on differences between market-implied volatility (IV) and theoretical fair volatility, rather than predicting price moves.

Basic Approach:

Buy options when implied volatility is lower than fair volatility.

Sell options when implied volatility is higher than fair volatility.

This approach allows traders to potentially earn consistent alpha by exploiting small inefficiencies in the options market while maintaining a delta-neutral position.

Steps to Implement a Heston Model Volatility Arbitrage Strategy

Estimate Fair Volatility

Use Heston Model parameters:Long-term historical volatility

Mean reversion speed

Correlation coefficient (ρ)

Volatility of volatility (σ)

Compare With Market IV

If IV > Fair Volatility → options may be overpriced → consider selling in simulation.

If IV < Fair Volatility → options may be underpriced → consider buying in simulation.

Construct Market-Neutral Trades

Long straddles or short hedges

Calendar spreads

Delta-neutral portfolios

Variance swaps / VIX hedges

Regularly Rebalance

Even in educational simulations, it’s important to track changes in delta and volatility to understand strategy mechanics.

Real-World Educational Example

Suppose the Heston Model estimates fair volatility at 25%, but the market shows IV at 33%.

Simulation Idea:

Conceptually sell a straddle.

Hedge delta using underlying shares in a demo account or paper trading.

Observe how profits or losses evolve if volatility moves toward fair value.

This example is for learning only and is not a recommendation to trade.

Common Mistakes and How to Avoid Them

| Mistake | Educational Fix |

|---|---|

| Blindly using Black-Scholes IV | Compare with Heston Model fair volatility |

| Ignoring delta-neutral adjustments | Simulate regular rebalancing |

| Neglecting correlation (ρ) | Include correlation in study |

| Trading in low liquidity | Observe results in paper trading only |

Benefits of Studying Heston Model Volatility Arbitrage

Understanding Mispricing: Learn how earnings, news, and liquidity affect option prices.

Market-Neutral Concepts: Focus on volatility rather than directional bets.

Low-Risk Learning: Ideal for simulations and educational purposes.

Applicable Across Markets: Stocks, commodities, and crypto for safe conceptual learning.

Educational Disclaimer

This article explains the Heston Model and volatility arbitrage for educational purposes only. Real trading carries financial risk and may not be suitable for all investors. Avoid speculative or interest-based strategies, and ensure compliance with ethical and legal guidelines.