Robinhood Traffic Plummets — What’s Behind the Drop?

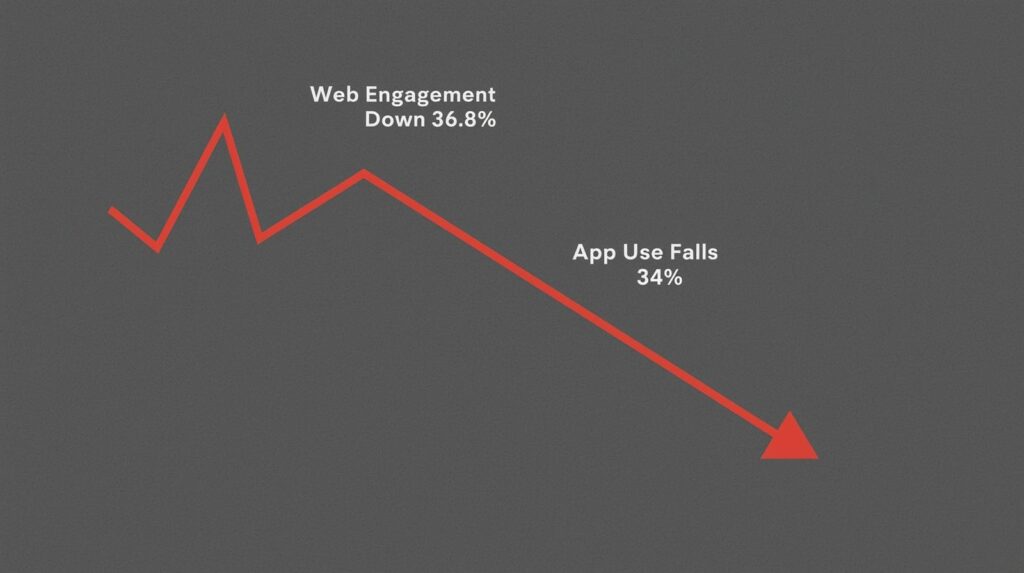

The once-booming retail trading platform Robinhood has hit a rough patch. Recent digital metrics reveal that in Q1 the company’s website visits fell by 36.8%, while usage of its mobile app dropped by 34%. Similarweb

Web & App Slump: The Facts

According to analysis from Similarweb, Robinhood’s significant decrease in user engagement marks the largest web traffic drop among major retail trading services in the U.S. during the same period. Similarweb

The website saw a year-over-year decline of 36.8%. Similarweb

The mobile app’s monthly active users on Android dropped by 34%. Similarweb

For context, competitors like Coinbase and Binance US recorded even steeper drops of 51% and 42.2% respectively. Similarweb

What’s Driving the Decline?

Several factors appear to be contributing to Robinhood’s engagement slump:

Market conditions: After 2021’s explosive growth in trading and crypto activity, the momentum has slowed.

Diminished novelty: Robinhood’s original appeal—easy access, commission-free trades, and gamified features—may no longer be enough to retain users.

Stricter oversight & controversies: The platform has faced regulatory scrutiny and criticism, which may affect user trust and perception.

Increased competition from established brokers: Firms like Fidelity Investments and Charles Schwab Corporation are facing smaller declines, showing strength in user retention. Similarweb

Implications for Robinhood

The sharp drop in both web and app engagement matters for Robinhood’s future:

Reduced ad-revenue and monetization potential: With fewer active users, monetizing through subscriptions or premium services becomes harder.

Investor confidence might waver: Declining engagement could influence how the market views Robinhood’s growth trajectory and profitability.

Need for strategy shift: To bounce back, Robinhood may need to innovate new features, improve user retention, or diversify its offerings beyond trading.

What Can Robinhood Do?

Robinhood could consider:

Enhancing the mobile-app experience to re-engage users with features that go beyond simple trade execution.

Strengthening trust and transparency in response to regulatory pressure and negative sentiment.

Exploring value-added services (education, social features, advanced tools) to differentiate itself.

Leveraging analytics to identify what causes users to drop off and then acting quickly to reduce churn.

Conclusion

Robinhood’s nearly one-third drop in web and app usage is a wake-up call. While the broader market for retail trading has cooled, the size of the fall highlights challenges ahead. To stay relevant, Robinhood must evolve—improving its experience, rebuilding trust, and defining a clear path forward in a mature market.